The Herd is coming.

Mike Novogratz’s now famous metaphor has inspired what can only be called a sense of inevitability. The inevitability of institutional capital. The Herd is a very powerful narrative that has gripped the space’s imagination for the “next wave” of the industry, to the point where old money’s long-awaited entrance often seems like a sure bet. When we delve into the details, the picture is complicated and harder to make sense of. Even if The Herd wanted to flood the gates open and embrace crypto-assets immediately, could they do it? The institutional infrastructure that old money needs is extremely underdeveloped.

Despite recent developments in custody and regulation, the ecosystem is yet to address the pain points holding institutions back. There has been progress — this we don’t doubt —infrastructure announced by players like Bakkt and just this week, CITI, cannot be understated. But is this enough? Is it the progress of institutional groundswell, the progress risk-averse and compliance-focused old money needs to be confident in the new asset class?

This piece is the first in a series, where we will explore the fundamental roadblocks to institutional capital. We hope to unpack not just the crypto-asset institutional landscape, but the dynamics at play when thinking about institutional capital. How do institutions think? What do they need? What are the pain points that keep them from embracing crypto?

But first, how big is The Herd?

With Goldman and Morgan acting as the clearing agents, the CBOE and CME futures offerings were the first serious rattles of Wall Street interest. It is not a stretch to associate the Bitcoin futures — hallmarks of institutional curiosity — with the mania that followed in Q4 of 2017.

However, the fact remains that the vast majority of old money is not even looking at crypto. If we peer over the fence and look to markets The Herd normally resides in, it is astounding to think about just how much capital is not touching crypto. The stock market in the US alone has a market capitalization of around $34 trillion, over 170 times the size of the current crypto market cap. When comparing with 60 major stock exchanges globally, this number is closer to 345x. Of course, equities are the tip of the iceberg: 2018’s Q1 numbers for the value of bond deals in international debt capital markets lie at an astounding $140 trillion. For the purposes of this article, these two asset classes make the point clear enough, and we won’t delve into the numbers for FX, commodities and real estate, even though there are very strong reasons why capital in each of these asset classes could and should (in theory) be looking at crypto.

When looking at these numbers, some of the headlines that have excited the crypto space in 2018 seem less dramatic than their reception. Goldman Sachs plans to open a Bitcoin trading desk and Goldman-backed Circle bought Poloniex. Barclays is interested in in starting its own trading desk and Soros gives the green light to trade crypto. Bakkt’s institutional onramp, which includes physically-settled Bitcoin futures, is also some of the biggest news of 2018.

These aren’t trivial developments, but are they signs that The Herd is well on the way? It is hard to say. The vast majority of institutional investorscontinue to operate in traditional markets and asset classes with no interest or move into crypto whatsoever. In reality, most old money is not just ignoring crypto, but actively disinterested and skeptical. Goldman and Barclays are crypto-curious, and this is great, but are these the “initiatives” that will propel a global ecosystem of fund and asset managers into the crypto wild?

The picture is more complicated than the elegance of Novogratz’s metaphor. Outside of the crypto-curious pioneers, why is old money so reluctant? In the rest of this article, we will briefly touch on the pain points and roadblocks that we believe are keeping institutional money sidelined. We will explore each pain point in depth in later articles.

Pain Point #1: Regulatory Uncertainty…

Old money cares more about regulatory clarity and compliance than it does about opportunity. For a traditional asset manager, regulatory uncertainty is a heavy, and paralyzing, burden. It goes without saying that financial institutions will struggle to justify deploying capital into crypto while crypto remains legally undefined. While blockchain companies often think in terms of upside and have an extremely agile and open risk tolerance, traditional financial institutions do not share this appetite: their world is a very different one, bludgeoned by compliance overheads, fiduciary duty and regulatory oversight.

It’s hard to describe the existing regulatory climate as anything but confusing. Even within a single country, there are often mixed signals between regulators; epitomized by the differing mandates and approaches taken between the CFTC and SEC. Stern crackdowns in Asia and mixed signals in the US have pushed many crypto companies to jurisdictions like Singapore and Switzerland, where a lighter touch has prevailed.

But even in these more crypto-friendly jurisdictions, the path is unclear. None of the debates have any semblance of clarity: when is a token a security, utility, commodity or currency? There is close to no jurisprudence or regulatory framework that covers any of these legal questions substantively. Moreover, most banks won’t touch crypto, and there’s a world of trouble in KYC and AML that terrifies most of these financial institutions.

On the edges, small, agile jurisdictions like Gibraltrar, Malta and Bermudahave opened their gates as hubs for crypto. However, for many large institutions, these countries are not viable gateways into the asset class, as in many cases they don’t have established international reputations as existing centers of banking and finance.

No matter how it is spun, crypto regulation is uncharted territory. It’s not true to say that institutional investors cannot enter — they can. But will they, given the undefined landscape? Can they, amidst this confusion, enter with confidence, clarity and certainty, that they are in a well-defined legal setting, where compliance is still king? Unfortunately both for the ecosystem and for The Herd to-be, the answer here is rather bleak.

Pain Point #2: A Custodial Nightmare

While retail holders have embraced the concept of BYOB (Be Your Own Bank) as a new form of financial autonomy, custody is at the heart of traditional finance. Institutional investors are not interested in the financial autonomy that private keys present — this notion of financial autonomy only terrifies them. A hedge fund cannot enter a market where a lost ledger or forgotten private key means that a client’s assets are no longer under management. BYOB empowers the individual, yet it only deters institutional money.

The custody problem, arguably as critical as regulation, is a roadblock between the old and new financial systems. While industry leaders like Coinbase among others have paved the way and introduced custodial products for professional investors, the existing custody landscape is far from institutional-grade. Part of being institutional-grade means not just providing the service, but also the professional support, trust and relationship management that traditional investors have grown accustomed to in the old world.

We will explore the deep challenges of custody in a later piece. We again pose the question — how do institutions think? It is not in terms of opportunity and upside, but risk-adjusted return and, to some extent, familiarity. In the same video where Novogratz announced The Herd was coming, he also mentioned that the vast majority of American wealth resides with people who are over sixty. The largest pension funds in the world, as it stands, have zero crypto exposure. Crypto will only be palatable to these players when the security, safety and friction-less service around custody is palatable not to Millennial Bitcoiners, but to an older, risk-averse and technologically conservative demographic.

Financial custody is not just about asset security; it is about a culture of trust. The irony is that crypto’s institutional adoption will require deep trust from legacy, existing financial players, who put their trust not only in the asset class, but in the reputation and service of the custodians who serve them. Institutional incumbents need to be able to justify any decision made to the board and vouch for the legitimacy and flawlessness of their custodian.

Pain Point #3: Liquidity

The largest ever crypto margin call sized up at $460m on OKEx Bitcoin Futures, but a massive $416m was left unfilled. The order was margin called, but couldn’t be filled, wiping the entire orderbook. In crypto, orderbooks are infamously thin, and exchanges don’t have the liquidity professional investors require. Wide spreads are a deal breaker for many institutional traders, particularly those focused on HFT (high-frequency trading) or algorithmic methodologies.

While Bitcoin and Ethereum (the “majors”) are relatively liquid on large exchanges, spreads are much wider than in other highly liquid markets these traders are used to (i.e FX). Even if The Herd could come, the order books might not be able to handle them! For one, they won’t be able to trade the volumes they are used to. They would also be forced to trade in an exchange landscape (particularly for smaller cap coins) with huge slippage and price discovery failures.

Institutional liquidity is a chicken-and-egg problem: there is not enough liquidity because institutions aren’t trading, and institutions aren’t trading because there is not enough liquidity. Part of this is also because of siloed markets — there is only so much that arbitrage can do. Ultimately, liquidity is a fundamental problem and we can’t cover how we think exchanges and liquidity providers can professionalize the market (and thicken the order-books) in this one post. Suffice to say; it will continue to sideline big money.

Pain Point #4: Stone-Age Customer Service

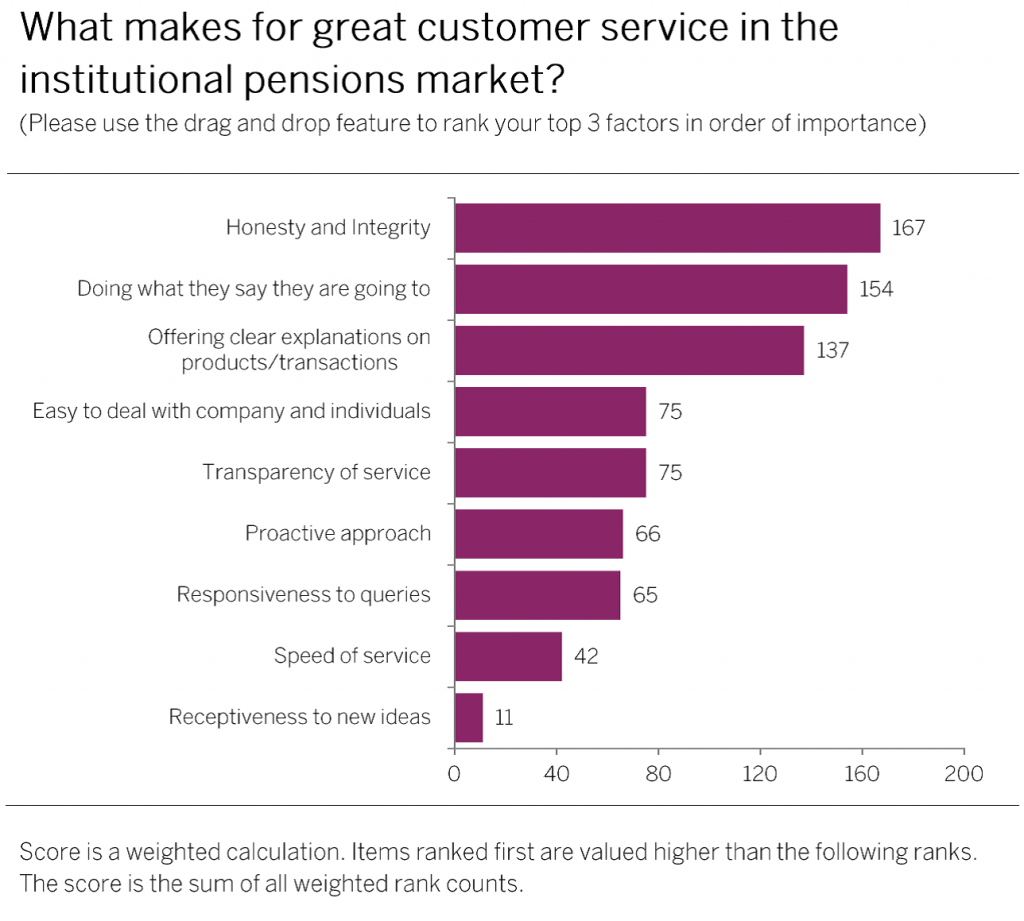

The old world has grown accustomed to being able to pick up the phone and talk to any broker or financial services provider in a heartbeat. This is basically non-existent in crypto. Crypto’s customer service is stone-age. The current exchanges landscape not only lacks customer service — let alone dedicated Account Managers — it is filled with stories of disgruntled clientsspending months to follow up and resolve challenges with their problems, including locked or stuck funds.

The existing landscape of “customer service” is geared toward retail clients. This is fine, in a market composed primarily of retail investors and traders. However, The Herd is used to a very different world of customer service, follow up and close and careful relationship management. This is at the heart of most financial offerings, and it is challenging to position crypto as a legitimate, independent asset class, when it lacks any of the distinct customer service offerings that almost all other asset classes have at the core of their financial offerings.

Pain Point #5: A Lack of Reliable Data & Sophisticated Analytics

While traditional investors have for decades relied on complex analytics and data tools, the crypto markets lack this sophistication. Hedge funds cannot function without their Terminal (or the price-competitive alternatives that have emerged in recent years), whereas crypto’s data landscape is fragmented, unreliable and sometimes fraudulent. Analytics is very important to institutional investors, and while are some projects working on key asset and data management tools, there are no sweeping solutions that have gripped professional investors.

Part of this can be pinned to the silos between exchanges and the resulting inaccuracies on aggregators like coinmarketcap. Moreover, aggregators like coinmarketcap simply have too much sway over the market, without enough smooth and time-tested trust in their underlying methodology for data collection. When changes on coinmarketcap can spark selloffs in minutes, we know there is a problem, and it is a far cry from the comforts of Bloomberg Markets and The Terminal (or the Reuters alternative).

Why The Herd is Yet To Arrive?

The Herd is yet to arrive because there is a suite of pain points that have not been addressed in any meaningful way. The expectations of The Herd are very different than most retail investors, and they come from an environment that is used to a culture of compliance, tailored custody, liquid markets and institutional-grade customer service.

We have only scratched the surface, and there are a number of other “pain points” we have left out for the sake of brevity. We will continue to explore each of the above problems in future posts.

Ultimately, crypto-assets will emerge into an asset class that attracts swaths of institutional capital — we believe this very strongly, which is why we are building an institutional exchange. However, it will not happen overnight, and it won’t happen because the ecosystem declares it so: The Herd will come only when the industry itself is ready, mature, and institutional-grade.

As it stands, it is too difficult a sell. Even if fund managers and crypto-curious advocates from within believe in the asset class’ future, the existing infrastructure is underdeveloped and falls short of traditional investor expectations. Despite headlines of Wall Street curiosity, the building blocks are not there, and the vast majority of institutional capital cannot — even if the old, risk-averse fund managers so desired — enter the space.

Ultimately, institutional investors will make their way in, if responsible, professional companies and advocates within the ecosystem can bridge the gap between the old and the new financial worlds. The Herd will come if we hold its hand, as Novogratz has done. Not just this, The Herd will come if we speak its language, reminding traditional investors not just of the enormous potential, but the safety, security, familiarity, and sophistication of this emerging asset class.